Recently I had the opportunity to do one of the key note presentations at the CFO Leadership Summit 2015. I spoke on a range of issues that keep CFOs awake. One of the main issues is Controls and Compliance. As a company specializing in expense and procurement management we have very deep experience in this area.

Here’s a summary of my presentation..

Priority areas of CFOs

CFOs are currently focused on 3 broad aspects, based on our research:- Controls and Compliance Requirements

- Revenue & Earnings – Level and Growth

- Funds Flow or Cash Flow – Budgets and Expenses

Varying levels of “Controls and Compliance” across countries

Controls and Compliance requirements are an area of high interest as each country gears up for better compliance. However, the level of “Controls and compliance” varies across countries.5 factors that result in a lower level in some countries are:- “Dawning Awareness” – Companies just realizing the importance and have not yet figured out an effective way to achieve desired levels.

- “Busyness” – Too much focus on day-to-day operations. Compliance objectives not getting prioritized.

- “Attachment to Status Quo”– The ‘if it isn’t broke is it, why fix it?” syndrome.

- “Delusion” – “We have an ERP so we are good on Controls and Compliance”.

- “Low Benchmarks” –“We are already the cleanest in our industry”.

A Framework to meet high levels of “Controls and Compliance”

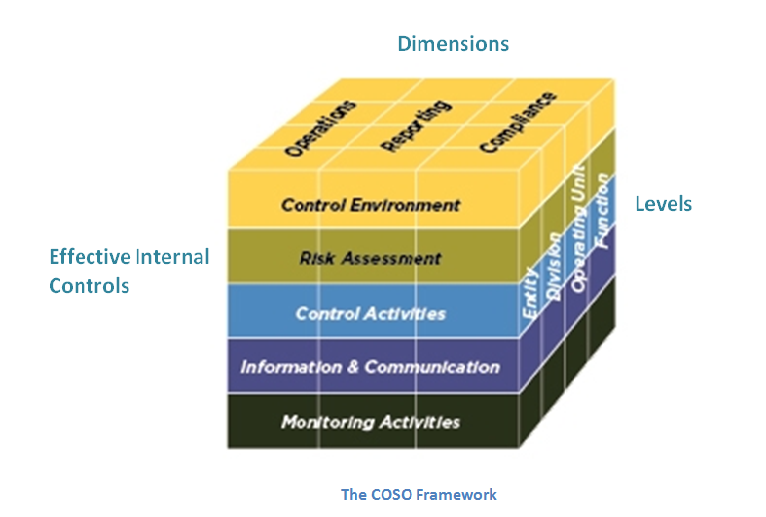

The COSO framework (see diagram below) is an excellent framework that can help move towards this objective.COSO is a voluntary private-sector initiative by dedicated to improving organizational performance and governance through effective internal control, enterprise risk management, and fraud. Refer to coso.org.

Expenzing helps meet your “Controls and Compliance” objective

Effective internal controls can be implemented through Expenzing. These can be across all the dimensions of your organization. A few examples are listed here.“Monitoring Activities” can be facilitated through the use of exception reporting and dashboards.Expenzing facilitates sharing of “Information & Communication” before authorizing any commitment to procure, or a payment for a supplier bill. Queries, checklists, attached supportings are just a few of the ways in which information is shared.“Control Activities” like establishing Rate Cards with Suppliers, having a Maker-Checker process for empaneling any vendor, or creating a due diligence checklist are some examples of Expenzing controls.Budgeting controls, vendor analysis for critical supplies, outstanding invoices are a few of the “Risk Assessment and mitigation” tools in our product.All in all, the combination of an excellent framework like COSO with a sophisticated tool like Expenzing for Procure-to-Pay processes, expense management and budgeting controls, is an effective way to achieve high Controls and Compliance.Recently I had the opportunity to do one of the key note presentations at the CFO Leadership Summit 2015. I spoke on a range of issues that keep CFOs awake. One of the main issues is Controls and Compliance. As a company specializing in expense and procurement management we have very deep experience in this area.

Here’s a summary of my presentation..

Priority areas of CFOs

CFOs are currently focused on 3 broad aspects, based on our research:

- Controls and Compliance Requirements

- Revenue & Earnings – Level and Growth

- Funds Flow or Cash Flow – Budgets and Expenses

Varying levels of “Controls and Compliance” across countries

Controls and Compliance requirements are an area of high interest as each country gears up for better compliance. However, the level of “Controls and compliance” varies across countries.

5 factors that result in a lower level in some countries are:

- Dawning Awareness – Companies just realizing the importance and have not yet figured out an effective way to achieve desired levels.

- Busyness – Too much focus on day-to-day operations. Compliance objectives not getting prioritized.

- Attachment to Status Quo– The ‘if it isn’t broke is it, why fix it? syndrome.

- Delusion– We have an ERP so we are good on Controls and Compliance”.

- Low Benchmarks –We are already the cleanest in our industry.

A Framework to meet high levels of “Controls and Compliance”

The COSO framework (see diagram below) is an excellent framework that can help move towards this objective.

COSO is a voluntary private-sector initiative by dedicated to improving organizational performance and governance through effective internal control, enterprise risk management, and fraud. Refer to coso.org.

Expenzing helps meet your “Controls and Compliance” objective

Effective internal controls can be implemented through Expenzing. These can be across all the dimensions of your organization. A few examples are listed here.

“Monitoring Activities” can be facilitated through the use of exception reporting and dashboards.

Expenzing facilitates sharing of “Information & Communication” before authorizing any commitment to procure, or a payment for a supplier bill. Queries, checklists, attached supportings are just a few of the ways in which information is shared.

“Control Activities” like establishing Rate Cards with Suppliers, having a Maker-Checker process for empaneling any vendor, or creating a due diligence checklist are some examples of Expenzing controls.

Budgeting controls, vendor analysis for critical supplies, outstanding invoices are a few of the “Risk Assessment and mitigation” tools in our product.

All in all, the combination of an excellent framework like COSO with a sophisticated tool like Expenzing for Procure-to-Pay processes, expense management and budgeting controls, is an effective way to achieve high Controls and Compliance.